GST payment

Thats because Bill C-30 has passed doubling the GST Tax. Goods Services Tax GST Payments.

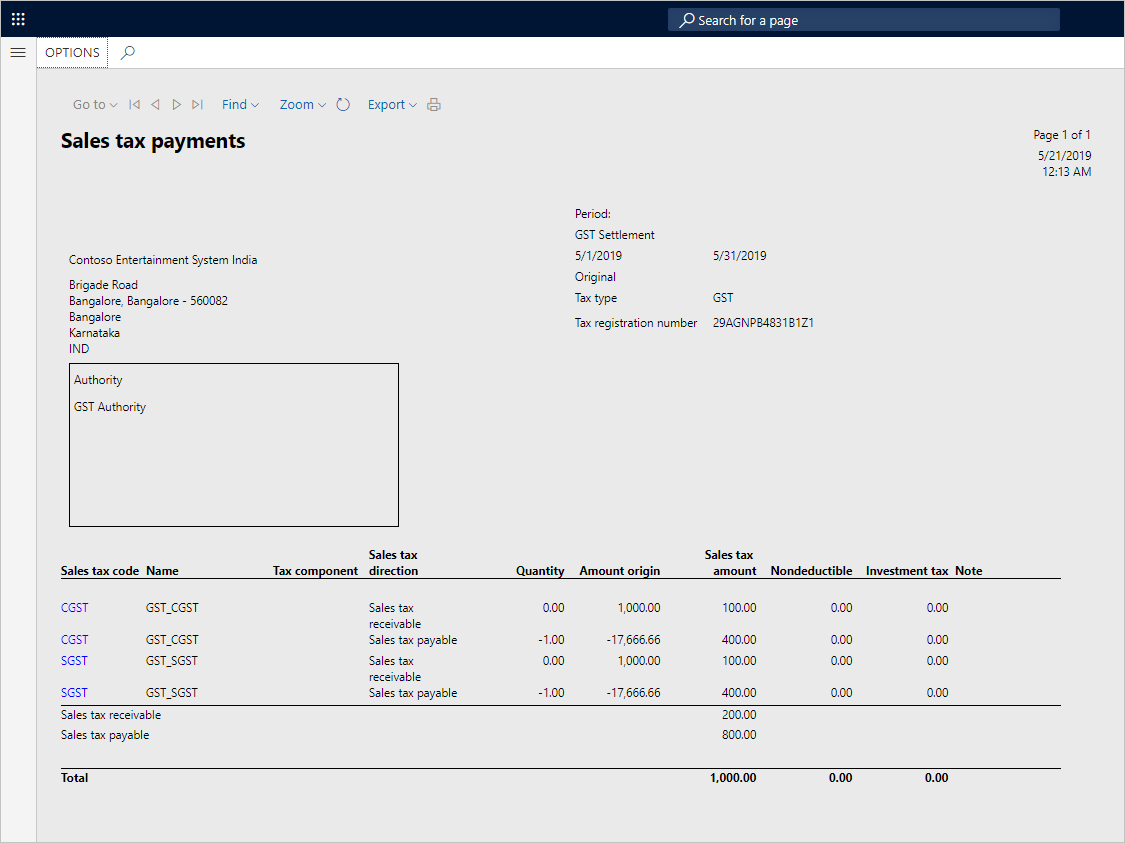

Rule Based Tax Settlement Finance Dynamics 365 Microsoft Learn

Therefore those who apply and qualify can receive four special payments from the Canadian government each.

. Grievance against PaymentGST PMT-07 Grievance. Your GST payment is due on the same day as your GST return. Calculating GST Payment Due.

According to Trudeau for the next six months Canadians. If you do not receive your GSTHST credit. RMCD - GST.

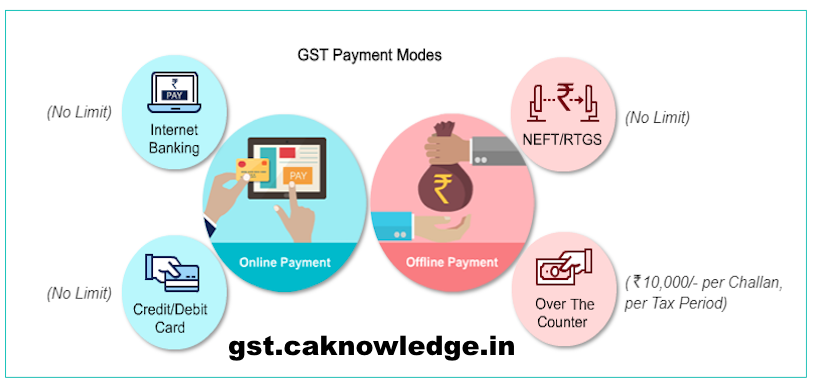

Make your GST payment in this step via netbanking or debitcredit card as chosen by you. You can claim a GST refund if your customer has not paid you within six months of the sale Completing your GST return A step-by-step guide to completing your GST return online. Click on View Receipt to view the GST payment you just made.

The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. 3 months after fiscal year-end. If your business income is reasonably consistent throughout the year you might prefer to pay a GST instalment amount option 3 in your business activity statement.

Payments can be received through direct. Challan History Track Payment Status. After filing GSTR-3 the GST Monthly Return the GST payment.

End of reporting period. 3 months after fiscal year-end. The payment dates for GST and HST this year are.

Weu2019ve doubled the GST Tax Credit for 6 months for nearly 11 million households u2013 single Canadians without kids will get up to 234 more couples with two. Your GST reporting and payment cycle will be one of the following. GSTHST payment and filing deadlines Payment deadline Filing deadline Example.

The amount is calculated based on your family situation in October. Monthly if your GST turnover is 20 million or more. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the date of the tax credit arises.

Application for Deferred PaymentPayment in Instalments. Goods and Services Tax. GSTHST Payment Dates for 2022.

Millions of Canadians woke up Friday morning with hundreds of dollars from Canadas federal government. This is an amount we. This one-time GST credit payment will be double the amount of the GST credit you would receive over a six-month period.

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. If your output tax exceeds the input tax the difference shall be remitted to the Government together with the GST. The GST credit program comes in the form of quarterly payments.

Pay domestic GST Use this account number if youre paying any amount due on your GST return to Revenue Jersey Quote your GST registration number as your reference Bank. For Calculating GST Payment Due Electronic Liability Ledger should be used. Quarterly if your GST turnover is less than 20 million and we have.

GST Payment Dates in 2022. The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the additional one-time goods and services tax credit. Tax refunds made via cheques.

This is the 28th of the month after the end of your taxable period. For example the taxable period ending 31 May is due 28 June. The Prime Minister of Canada took to Twitter on Monday to make an announcement that will affect 11 million households.

GST ePayment is an introduction about GST Act GST Tax Rate GST Updates GST Notifications GST Rules GST Payment Register GST and many more.

Gst Payment Challan How To Make Gst Payments Vakilsearch

Gst Online Payment Process Mybillbook

How To Make Gst Payment Gst Payment Process Gst Create Challan

How To Make Gst Payment Modes Step By Step Guide And Tips For Gst Payment

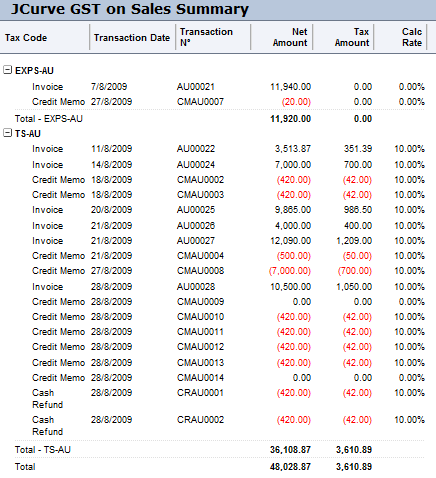

Bas Payment Of Gst Payg Jcurve Solutions

Create Gst Payment Challan Step By Step Guide On Gst Portal Indiafilings

Gst Challan Payment Process To Pay Gst Online Learn By Quicko

![]()

Audit Exemption Gst Paid Save Icon Download On Iconfinder

Can Not Make Gst Payment On Remittance Module General Discussion Sage 50 Accounting Canadian Edition Sage City Community

Gst Payment Process Rules Form How To Pay Gst Online

Gst Payment Stepwise Process To Pay Gst Online Offline

![]()

Audit Exemption Gst Paid Save Icon Download On Iconfinder

How To Easily Remit Gst Hst With The Purchase Invoice Module

Gst Payment Dates 2022 2023 Gst Double Payment Explained

Steps By Step Guide To Make Gst Payment Tax Payment In Gst